The Long View: Engineering a New Framework for Crypto Investment

In the whirlwind world of cryptocurrency, where market sentiment can pivot on a single tweet, Spencer Randall has spent eight years building something different: a rigorous, data-driven approach to digital asset investment that’s helping reshape how institutions approach the crypto market. His companies, CryptoEQ and Event Horizon Capital, stand as testament to the power of meticulous analysis in an industry often driven by hype and FOMO. The results speak for themselves.

His initial cautious step in 2017—a 5% allocation of his personal portfolio—belied the intensity of his commitment. Within months, Randall found himself pouring over thirty white papers, trying to grasp the fundamental architecture of this new financial frontier.

The ensuing eight years in crypto, Randall notes, feel more like three decades. The compressed nature of crypto market cycles—where assets can swing 80% to 99% in months rather than years—means veterans like Randall have weathered more financial storms than many traditional fund managers see in their entire careers. This battle-tested experience has proven invaluable as his companies, CryptoEQ and Event Horizon Capital, help guide both retail and institutional investors through digital asset markets.

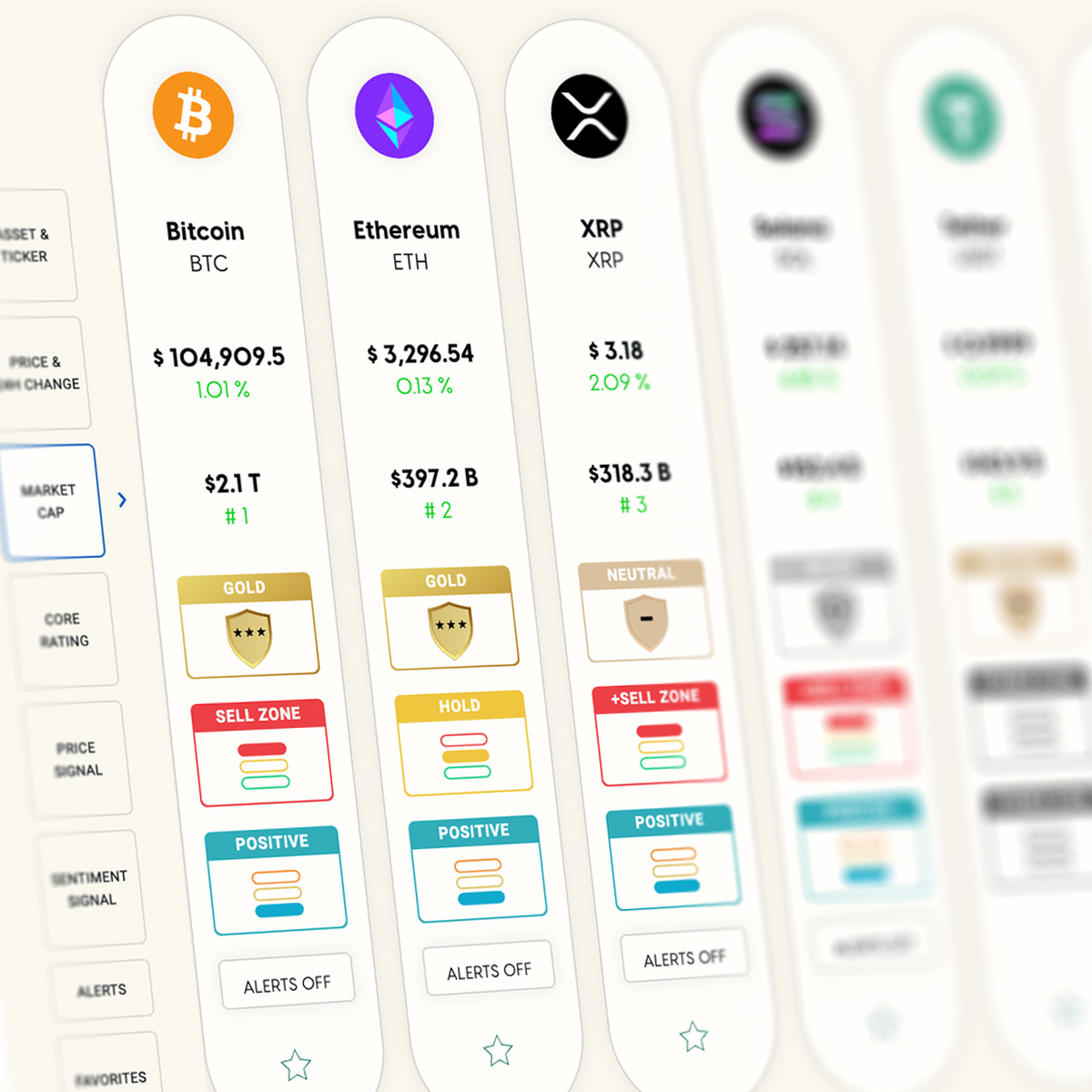

CryptoEQ, aptly dubbed “the Morningstar of crypto,” exemplifies Randall’s methodical approach to market analysis. The firm has built sophisticated evaluation frameworks that cut through market noise to assess the technical fundamentals of blockchain networks and their native assets. After evaluating thousands of cryptocurrencies over eight years, the firm has awarded its highest confidence ratings to just five assets. This selectivity speaks volumes in an industry where new tokens launch daily. This isn’t conservatism—it’s precision.

This disciplined framework proved its worth when Randall started the pilot fund that eventually became Event Horizon Capital. Over nine quarters spanning the volatile period from late 2019 through early 2022—including the pandemic surge and subsequent crash—the fund outperformed Bitcoin by 100%. More importantly, it maintained significant gains even through the market’s darkest moments. What sets Randall’s enterprises apart is their organic growth model, which mirrors the decentralized ethos of Bitcoin itself. Both companies began as community initiatives—CryptoEQ emerged from a Houston crypto meetup that dwindled to fifteen dedicated members during the brutal 2018 bear market. “That’s how I met my co-founders,” Randall notes, “the folks that were serious about the market when it made basically no sense at all.”

This grassroots approach extends to their funding strategy. Unlike many ventures that chase venture capital and quick growth, both companies were bootstrapped with the founders’ own capital. “Everything we’ve done, we started by putting our own money at risk,” Randall emphasizes. He calls this approach “anti-fragile”—a system that grows stronger through stress and iteration, much like the blockchain networks he studies.

Today, with a team of nineteen across both companies, Randall’s vision extends far beyond trading gains. His highest-conviction belief—which he puts at 95% certainty—is that Bitcoin will eventually surpass gold to become the world’s most valuable asset. But perhaps more intriguingly, he sees crypto technology becoming invisible to end users: “Billions of people will use crypto when they don’t even know that it’s crypto,” he predicts, envisioning a future where blockchain powers familiar interfaces while making transactions “an order of magnitude more cost-effective, efficient, and faster.”

Randall sees Houston as an inevitable hub for entrepreneurial innovation—a city with the scale, talent, and drive to build a thriving ecosystem. “We have the density, the leadership, and the long-term vision to make Houston a powerhouse for founders,” he says. His work with Helium Capital aligns with that ambition, leveraging research, investment, and a commitment to building sustainable ventures in the city. By fostering disciplined investment strategies and rigorous market analysis, his companies contribute to a business landscape where Houston can emerge as a center for digital asset innovation.

Randall and his team are positioning themselves at the forefront of a rapidly evolving landscape. As major players like BlackRock enter the crypto market through ETFs, Randall sees 2025 as “the best time in the history to be in crypto.” His companies stand ready to guide this institutional wave with battle-tested frameworks and a deep understanding of both the technology and market

dynamics.

With institutional capital pouring in and crypto entering its next chapter, Randall’s vision is clear: this isn’t just the best time to be in crypto—it’s the moment he’s been building for. For someone who started with a conservative 5% allocation to Bitcoin, Randall has engineered something remarkable: a new paradigm for digital investment.